Malaysia Share Market Update November 2025

Malaysia Share Market: November 2025 in Review – Resilience, Green Momentum & Selective Opportunities

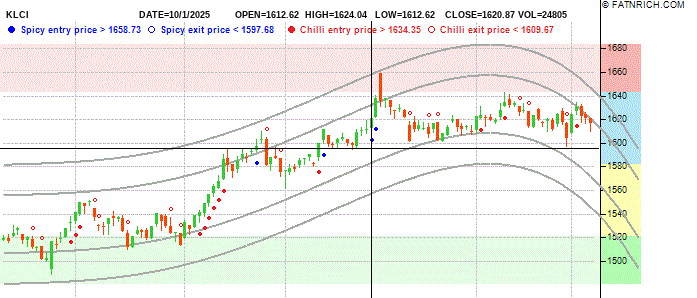

November 2025 proved to be a month of quiet strength for Bursa Malaysia. Despite lingering global trade concerns, the FBM KLCI ended the month up ~0.6% at approximately 1,635 points — a modest gain that masked significant sectoral rotation and emerging themes shaping the year ahead.

Here’s the complete picture from multiple angles.

Macro Resilience: Rate Hold Signals Confidence

Bank Negara Malaysia kept the Overnight Policy Rate unchanged at 2.75% on 6 November, reinforcing its view that the economy remains on solid footing despite external pressures.

- GDP growth outlook for 2025 reaffirmed at 4.5–5.5%

- Headline inflation projected at a comfortable 2.0–2.5%

- Ringgit appreciated ~1.2% against the USD during the month, reducing imported inflation risks

This steady-hand approach provided a supportive backdrop for domestic-oriented sectors while global tariff noise continued in the background.

Renewable Energy Takes Center Stage

November saw Malaysia’s green transition accelerate:

- Green Electricity Tariff (GET) subscriptions surged after the earlier 80% premium cut and full waiver of the 1.6% RE Fund charge

- Over 2.5 GW of new corporate green power agreements signed

- Battery Energy Storage System (BESS) tender results expected imminently, potentially awarding another 400 MW/1,600 MWh

- Solarvest, Vantage RE, and related supply-chain players were among the month’s top gainers (+8% to +18%)

The renewable energy sub-index rose 5.8% — the best-performing sector in November.

Banking & Financials: Steady as She Goes

Lower-for-longer funding costs continued to benefit the banking sector:

- Maybank +3.2%

- CIMB +4.1%

- Public Bank +2.8%

Loan growth remained healthy at ~5.7% YoY, with improving asset quality and stable net interest margins. Analysts upgraded earnings forecasts for several large-cap banks heading into 2026.

Export-Sensitive Sectors: Mixed Fortunes

Technology and glove makers felt ongoing pressure from US tariff adjustments, though the impact was less severe than feared:

- Inari Amertron −2.1% (sideways consolidation)

- Hartalega −1.4%

- Top Glove flat

Meanwhile, commodity-related names staged a late-month rebound on firmer crude palm oil and energy prices.

What We Think About The Share Market

The KLCI spent most of November in a tight 1,610–1,650 range before breaking mildly higher in the final week. Volume remained healthy, and breadth slightly favored gainers — classic consolidation behavior after the volatility seen earlier in the year.

We see the market entering a selective bull phase into 2026, led by renewable energy, banking, and domestic consumption plays.

Curious about the exact charting tools and indicators used for these calls? Drop me a private message on Telegram.

November reminded us that Malaysia’s market is increasingly driven by domestic policy strength and green growth themes — themes we expect to dominate 2026 as well.

Disclaimer: This post is for informational purposes only and does not constitute investment advice. Always do your own research before making any investment decisions.